Though you no longer need to display a paper tax disc in your car, the DVLA is clear about the fact that you still need to tax it. However, in light of the changes to the vehicle excise duty (VED) that came in in April 2017, it can be hard to know when and how to tax your car, how much it costs and what to do if you sell your vehicle.

CarTakeBack has put together this handy guide so you know how to pay road tax, what to do if you need to renew it, how to check a car has been taxed and more.

*Information below updated December 2020

Car tax has to be applied for, for all cars registered in the UK. The fee depends on the type of car you have. Unless you declare your car through a SORN (Statutory Off-Road Notification), you will still need to tax it, even if you keep it off-road, in a garage, on a driveway or on private land.

If you are caught with a registered vehicle that is not taxed, you will be fined and your vehicle will be clamped. However, some vehicles are exempt from car tax. Find out if this is the case for yours below.

Following the recent changes to the VED system, you’ll be hard-pressed to find a car with an exhaust that doesn’t need to pay road tax. However, some zero-emission cars, including fully electric vehicles and hydrogen-powered cars, are exempt from car tax.

Others include:

For an exhaustive list, visit gov.uk.

Your car needs to be taxed annually; you can choose to pay every 12 months, every six months or each month.

If you set up a direct debit, the payment will be taken on the first day of the month and the DVLA will not amend this date.

The benefit of paying by direct debit is that your tax will theoretically never expire as you’ll always be on top of your payments, provided your direct debit clears. You can find out more about direct debit payments for your car tax on the DVLA website.

How much you pay to tax your car varies depending on the type of car you own, as the rate is calculated based on the official quoted CO2 emissions for the vehicle.

There are currently 13 car bands for petrol and diesel, ranked from vehicles with low emissions – on which you pay nothing – right up to high-polluting cars that can face huge surpluses for taxing their car.

You can find a breakdown of costs on the DVLA website.

Since paper tax discs were abolished, DVLA has made it easy to pay road tax online.

You’ll need:

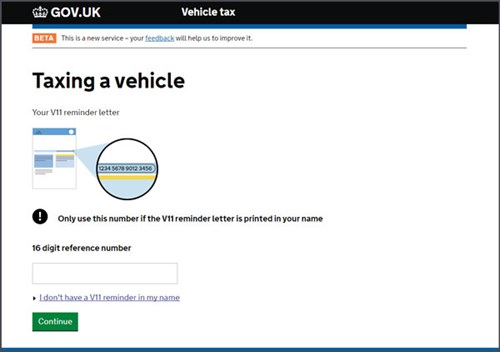

Go to Taxing a Vehicle on the gov.uk website.

As soon as you’ve confirmed your payment details, your car tax will be renewed. You’ll be given an application reference number and, if you gave your details, you’ll also receive a confirmation text or email from DVLA.

Remember, it’s now all online, so there’s no need to display a tax disc in your car anymore. If you want to double-check your car has been taxed or to find out how much the road tax for your car will be, see below.

The DVLA offers an online tool that shows you what information it holds about your car, including whether it has been taxed.

You’ll need:

This will tell you whether the car is taxed and when this expires.

DVLA’s Vehicle Enquiry Service can also show you how much tax you’ll need to pay.

You’ll need:

The DVLA will tell you exactly how much tax you’ll have to pay for six months, 12 months or by monthly direct debit.

If you sell or scrap your car before your road tax is due for renewal, you can reclaim the money from the DVLA.

When you tell the DVLA that you’ve sold, scrapped or exported your car, your car tax refund will be automatically sent to you. You are also entitled to a tax refund if you declare your care as SORN or it becomes exempt from road tax.

However, you will not automatically receive a refund if your car has been stolen; you will need to apply for a refund using the V33 form and include the crime reference number.

DVLA will post a cheque to the registered keeper shown on the registration certificate (V5C) within six weeks.

If you don’t receive your refund within six weeks, contact the DVLA.

It is no longer possible to transfer road tax from one car to another. Instead, the current owner of the vehicle can apply for a refund (see above) and the new owner has to re-tax the car. The new owner will have to tax the vehicle straight away before driving it.